Saturday, December 10, 2011

Wednesday, December 7, 2011

REMAX says Home sales will not stumble in 2012

675 Adelaide St. N.,

London ON N5Y 2L4

Tuesday, December 6, 2011

Thursday, December 1, 2011

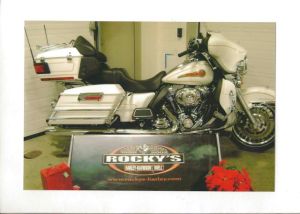

Fraser got his 1st Xmas Card - Its from his Harley Davidson - Great Marketing by Rocky's

675 Adelaide St. N.,

London ON N5Y 2L4

Wednesday, November 30, 2011

The Grants December 2011 Real Estate Ad.

Monday, November 21, 2011

Connie & Fraser Enjoying the Trade Show at the CCI/ACMO Conference

We really enjoyed the total conference. The trade show was an assume experience - congratulations to all the trades who showed real class. The GroundsGuys buddy was a bit intimidating don't you think?

Friday, November 18, 2011

Saturday, November 12, 2011

Plan To Attend The London Santa Claus Parade Today

Fraser at the 2010 London Santa Claus Parade. Look for Fraser in the parade again this year with the Bruce Shrine Club having fun raising money to help Shriner's Children. Do not forget to bring food for the food bank. If you see Fraser yell his name - he will be on a golf cart with lots of lights. Take his picture and post it for everybody to see. Merry Christmas.

Friday, November 11, 2011

Wednesday, November 9, 2011

Monday, November 7, 2011

THE GRANTS November Ad In The Club Real Estate Magazine

London ON N5Y 2L4

Thursday, November 3, 2011

A Reminder To Turn Your Clocks Back One Hour Saturday Night

675 Adelaide St. N.,

London ON N5Y 2L4

Thursday, October 27, 2011

Life Lesson From Steve Jobs

Broker, ACCI, FCCI, CRES, CMOC

Fraser Grant

Broker, CPM, FRI, CMOC, CRP, ACCI, FCCI

675 Adelaide St. N.,

London ON N5Y 2L4

Phone 519.667.1800

Friday, October 21, 2011

A Reminder That THE GRANTS Are On Radio This Saturday

675 Adelaide St. N.,

London ON N5Y 2L4

Thursday, October 20, 2011

London Real Estate Is Affected by Bulletin 2011-04 regarding forms related to Condominiums

Ministry of Government Services makes changes in relation to the operation of the Land Registry Offices will have an effect on the condominium industry

ACMO has advised us that recent changes made by the Ministry of Government Services in relation to the operation of the Land Registry Offices will have an effect on the condominium industry. Since the Regulations relating to the Condominium Act, 1998 were drafted and implemented on May 5, 2001 our industry has operated with standard forms that were created under those regulations.

On September 1, 2011 the Government of Ontario implemented bulletin 2011-04 ???Migration of Forms from Regulations??? which will have an impact on the names of forms related to the Condominium Act, 1998, and which also removes the numbers previously associated with these forms.

For the information and convenience of our members ACMO is including the following links to Government websites.

Click Here to view a copy of Bulletin 2011-04.

Click Here to view a list of the forms related to the Condominium Act, 1998 which were changed by Bulletin 2011-04.

The forms are available to be downloaded in Word or PDF format from the Government of Ontario website.

London ON N5Y 2L4

Tuesday, October 11, 2011

The Grants Just Listed a Great 2 Bedroom Condo in London - Details Soon

Sunday, October 9, 2011

Friday, October 7, 2011

Find the right mortgage solution to suit your needs

When arranging home financing, your clients must choose a fixed or variable interest rate mortgage.

A fixed interest rate mortgage ensures that their rate will stay the same through the term of the mortgage. The benefit is knowing exactly how much their payments will be for the entire term, simplifying their monthly budget. If interest rates rise, they are protected from any increase for their selected term.

Variable rate mortgages generally offer lower rates than some fixed rate mortgages. The advantage, over time, is that your client could potentially pay off their principal balance faster, while saving on interest costs. Of course, variable rates can fluctuate over the term of the mortgage. Should rates increase, your client may be faced with higher payments that they did not budget for.

Because interest rates are difficult to predict, it's important to find the right mortgage solution to suit your needs. We always encourage our clients to speak with a qualified mortgage specialist. If you are not sure who to call, you can always call us and we will recommend a mortgage specialist.

Monday, October 3, 2011

Just Listed - 954 Crestview Cr., London ON by The Grants London Ontario Real Estate Remax

954 Crestview Cr offers a living area that is open-concept with a neutral d??cor accentuated by large windows and plenty of sunlight. The kitchen is well planned with plenty of cupboard space and built-in appliances.

The main floor oversized laundry has extra closet space.

The basement is completely finished with two bedrooms, rec-room, washroom and additional rooms for office and hobbies. The lower level has a separate access from a side entrance.

There is plenty of room in the two-car garage, which has direct access to the laundry area of the main floor.

This home is located in a neighborhood that is quiet, new, friendly and close to all amenities. There is a park in the backyard and is walking distance to London???s finest, Springbank Park, with plenty of riverside trails which connect to trails throughout the City of London.

The location is situated in a good blend of urban and rural settings with excellent access to all major highways.

675 Adelaide St. N.,

London ON N5Y 2L4

Just Listed - 954 Crestview Cr., London ON by The Grants London Ontario Real Estate Remax

954 Crestview Cr offers a living area that is open-concept with a neutral décor accentuated by large windows and plenty of sunlight. The kitchen is well planned with plenty of cupboard space and built-in appliances.

The main floor oversized laundry has extra closet space.

The basement is completely finished with two bedrooms, rec-room, washroom and additional rooms for office and hobbies. The lower level has a separate access from a side entrance.

There is plenty of room in the two-car garage, which has direct access to the laundry area of the main floor.

This home is located in a neighborhood that is quiet, new, friendly and close to all amenities. There is a park in the backyard and is walking distance to London’s finest, Springbank Park, with plenty of riverside trails which connect to trails throughout the City of London.

The location is situated in a good blend of urban and rural settings with excellent access to all major highways.

Broker, ACCI, FCCI, CRES, CMOC

Fraser Grant

Broker, CPM, FRI, CMOC, CRP, ACCI, FCCI

675 Adelaide St. N.,

London ON N5Y 2L4

Phone 519.667.1800

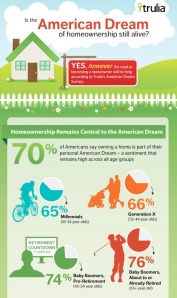

Buying a home a safer bet than buying gold (INFOGRAPHIC)

London ON N5Y 2L4

Wednesday, September 28, 2011

Tuesday, September 27, 2011

London Real Estate Effected By Smart Meters..... Well worth reading.........Scary stuff...........

Monday, September 26, 2011

Connie and Fraser are attending REMAX Centre City office meeting

Begin forwarded message:

From: Fraser Grant <efgrant45@me.com>

Date: 26 September, 2011 12:49:20 PM EDT

To: Undisclosed recipients: ;

Subject: Connie and Fraser are attending a REMAX Centre City office meeting

Please excuse my spelling and brevity. Sent from my iPhone

Saturday, September 17, 2011

Great Radio Show Today

675 Adelaide St. N.,

London ON N5Y 2L4

Wednesday, September 14, 2011

The Grants Are Talking Condo's @ Noon On CJBK 1290 Sat. Sept 17, 2011

675 Adelaide St. N.,

London ON N5Y 2L4

Tuesday, September 13, 2011

The Grants Just Listed 23-536 Third Street, London Ontario London Real Estate

Hi Everybody

Broker, ACCI, FCCI, CRES, CMOC

Broker, CPM, FRI, CMOC, CRP, ACCI, FCCI

675 Adelaide St. N.,

London ON N5Y 2L4

Phone 519.667.1800

Tuesday, September 6, 2011

Negotiating Your Real Estate Contract

The Importance of Using a 3rd Party Negotiator

Successful negotiating skills aren't just for the business world; they're for everyday situations. Whether you're renting a car, asking for a raise or trying to get your kids to clean up their room, negotiating skills are essential.

Negotiating is a life skill that can be easily learned and eventually perfected. Your success isn't based on how well you can argue but how well you're prepared. The best thing you can do before entering negotiations is to do your homework. Listening skills and a positive attitude are also very important.

A home purchase is a huge investment that's fraught with emotions. If you negotiate with someone directly in such an emotionally charged situation, chances are that negative personal feelings will get in the way. It's hard to recover once that happens and often times, the home of your dreams will be lost due to ego, pride and principle.

The home buying process comes with a very steep learning curve so it's best to use an agent to ensure there are no regrets. Buyer's remorse is no fun, especially when it comes to real estate. In order to successfully negotiate, you need to know as much as possible about the house itself, the motivations of the buyer/seller, the local market conditions and so on.

Real estate agents can also point you in the right direction when it comes to financing to ensure you receive a mortgage that satisfies the conditions of your offer. Mortgage brokers negotiate with several banks at once to create a bidding war for your business. They can then arrange financing quickly and at the best possible rates and terms which translates into thousands of dollars in savings.

Emotions run very high when it comes to buying or selling a home which is why it's important to have a real estate agent represent you as a 3rd party negotiator. Professionals are able to see things through to the end by remaining calm and not letting their emotions get in the way. If you're thinking about a move, please get in touch so we can discuss your options.

THE GRANTS are skilled negotiators and want all your real estate decisions to be good ones. Call us to-day @ 519-667-1800 or email sales@the-grants.com if you are thinking of buying or selling!

675 Adelaide St. N.,

London ON N5Y 2L4

Thursday, September 1, 2011

London Ontario Home Owners get Help With Energy Upgrades

Energy retrofit program renewed

The federal government has renewed the popular ecoENERGY Retrofit - Homes program. Until March 31, 2012, homeowners can receive grants up to $5,000 to make their homes more energy-efficient and save energy costs. This year’s program has two important changes. Participants must now register directly with the program before booking an evaluation. They must also provide receipts to their energy advisor at the time of the post-retrofit evaluation to confirm their eligibility for an ecoENERGY grant. Only products purchased after June 6, 2011, and installed after a pre-retrofit evaluation are eligible for a grant. Visit www.ecoaction.gc.ca/homes.

Broker, ACCI, FCCI, CRES, CMOC

Fraser Grant

Broker, CPM, FRI, CMOC, CRP, ACCI, FCCI

675 Adelaide St. N.,

London ON N5Y 2L4

Phone 519.667.1800

Condo to Castle to Condo

Thursday, August 25, 2011

The Grants Talk Real Estate On CJBK 1290 On Saturday Morning

675 Adelaide St. N.,

London ON N5Y 2L4

Thursday, August 18, 2011

SCOTIA BANK MORTGAGES HOUSING NEWS FLASH

MORTGAGES

Housing News Flash

MLS Home Sales — June 2011

Canadian housing activity remains resilient in the face of mounting global economic uncertainty and the squeeze on household budgets from high food and gas prices. Seasonally adjusted national home sales have risen to 2.6% m/m in June. The pickup follows several months of moderating activity following the implementation of more restrictive insured mortgage rules in mid-March, which likely brought forward some sales to the early part of the year. Overall, sales volumes are in line with the average of the past decade.

Steady job growth is a major factor supporting housing demand. The economy has generated an average of 32,000 new jobs a month this year, mostly full-time. Equally important, variable and fixed mortgage rates have remained at historically low levels, helping to maintain affordability despite near record home prices.

Sales are being matched by a reasonable supply of new listings in most markets, leading to fairly balanced conditions between buyers and sellers. The national ratio of new listings to sales stood at 1.90 in June, while the months’ supply of active listings was 6.0. This in turn has moderated price increases. The national average home price declined marginally on a month-to-month basis in each of the past three months, but this comes on the heels of a spike in prices in January and February. The early-year run-up was likely inflated by a rush to beat the regulatory changes as well as by a surge in high-end property transactions in Vancouver.

Higher interest rates and a slowing pace of job creation as public sector restraint measures take hold will likely cool housing demand next year. However, given expectations of moderate economic growth and only a gradual rise in interest rates, combined with limited high-risk mortgages, we maintain that the most likely outcome for Canada’s housing market over the next few years is not an abrupt downward correction but rather a period of relatively flat sales and pricing that eventually restores a better affordability balance.

This Report is prepared by Scotia Economics as a resource for the clients of Scotiabank and Scotia Capital. While the information is from sources believed reliable, neither the information nor the forecast shall be taken as a representation for which The Bank of Nova Scotia or Scotia Capital Inc. or any of their employees incur any responsibility.

Courtesy of your Scotiabank Mortgage Specialist

Anna Cipollone

Mortgage Development Manager

London & Surrounding

519-642-5042 Office

519-614-1974 Cell

Broker, ACCI, FCCI, CRES, CMOC

Fraser Grant

Broker, CPM, FRI, CMOC, CRP, ACCI, FCCI

675 Adelaide St. N.,

London ON N5Y 2L4

Phone 519.667.1800